Singapore banks are turning enemies into allies. Doomsayers have predicted the end of banking as we know it and hailed fintech as the most important innovation since the internet boom. But Singapore banks are not being annihilated by tech start-ups. Instead, they are joining hands with innovators to seek win-win outcomes.

The case for digital banking services in Singapore has become stronger due to COVID-19. A record number of digital banking transactions are taking place during the COVID-19 outbreak, pointing to a strong acceleration in fintech adoption. The number of customers who switched to digital banking have grown significantly, including those in the 60-80 age group. For example, more than 100,000 DBS Bank customers made their debut digital transactions from January to March 2020. Evidently, consumers who were initially resistant to digital channels are adopting out of necessity during these challenging times. The volume of digital payments has also increased significantly.

Singapore encourages innovation and adoption of digital banking, while maintaining marketing stability and limiting excessive disruption in the regional banking industry. The banks are alive and well, based on S&P Global Ratings' four-factor analysis on technology, regulation, industry, and preferences (TRIP).

From a bank's perspective, the advantages of fintech are straightforward. Large banking conglomerates are slow and held back by tradition and compliance to make an internal culture of innovation work. Tapping into an external talent pool of young minds is more efficient and much faster. Fintech partnership represents a ready and cost-efficient source of innovation that allows banks to preserve their relevance or even enhance their service standards to customers.

.. Read more at S&P Global here!

Employer Jobseeker

Share Link:

Related Posts

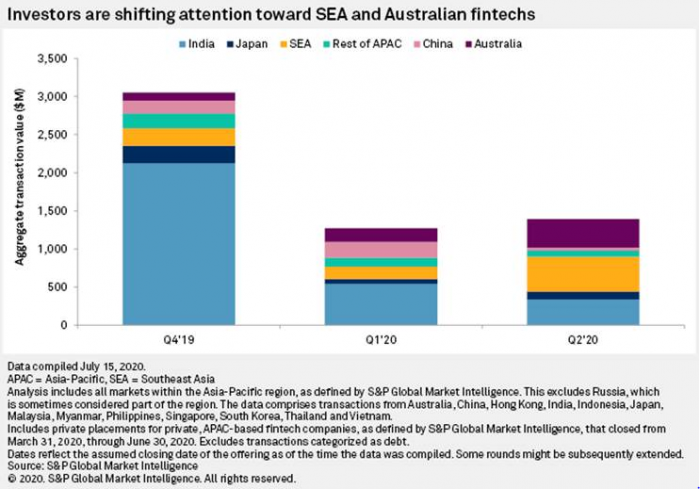

Investments in fintech companies in Asia-Pacific grew 9.1% to US$1.4 billion in the second quarter of 2020 when compared...

The COVID-19 outbreak has created various socio-economic challenges and has also accelerated the shift towards...